by NANCY HANOVER

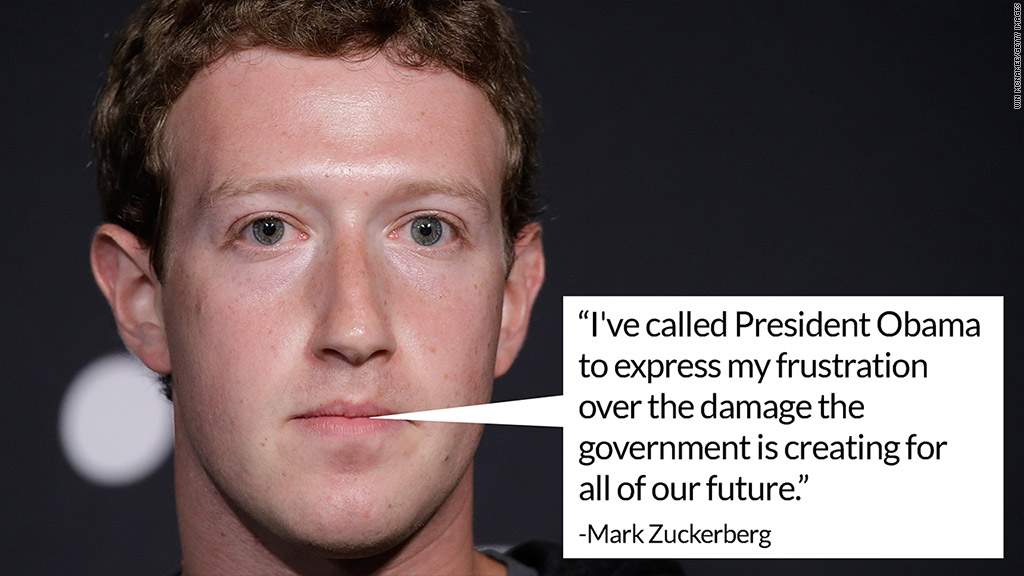

Facebook founder Mark Zuckerberg called President Obama to tell him the latest NSA disclosures are frustrating PHOTO/CNN

Facebook founder Mark Zuckerberg called President Obama to tell him the latest NSA disclosures are frustrating PHOTO/CNN

Last Tuesday Mark Zuckerberg, co-founder of Facebook and the 16th richest man in America, and his wife Priscilla Chan announced they would be donating 99 percent of their Facebook shares, currently valued at $45 billion, to charity during their lifetime.

The gift was announced in the form of a letter to their newborn child announcing the formation of the Chan Zuckerberg Initiative (CZI), a Limited Liability Company (LLC) dedicated to “advancing human potential and promoting equality” by means of “philanthropic, public advocacy, and other activities for the public good.” “Our initial areas of focus will be personalized learning, curing disease, connecting people and building strong communities,” the billionaires wrote.

The intended and immediate media reaction was gushing praise. The Guardian, for example, referred to Zuckerberg as a “generational superman” and stated, “The rest of us can probably agree, twitticisms aside, that a $45bn donation—more than double the Ford, Rockefeller, and Carnegie foundations put together—is pretty generous.”

“His previous extraordinary philanthropy gives plenty of reason for optimism,” continued the British newspaper, “whatever mis-steps there have been along the way. What will he do now? Can he manage his great gift without letting the political seep into the charitable? How will he change the world next?”

National Public Radio (NPR) enthused, “The letter has a sweeping vision, traversing social and political issues that are controversial.” It quotes Zuckerberg’s concern for those who “wonder whether you’ll have food or rent, or worry about abuse or crime potential,” and report his assurances that “investments in technology in particular can solve these problems.”

On a more somber note, the New Yorker hinted at the nervous worries of the ruling elite, baldly claiming, “Charitable giving on this scale makes modern capitalism, with all of its inequalities and injustices, seem somewhat more defensible.”

To all of this, the WSWS can only reply: far from it! Technology cannot solve the problem of social inequality. The journal Science just published a study entitled “ Democratizing education? Examining access and usage patterns in massive open online courses ” which confirms the fact, well known to public school teachers, that economic class—not technological access—is the overwhelming factor in determining educational success. Science goes even further to state, “Our findings raise concerns that MOOCs and similar approaches to online learning can exacerbate rather than reduce disparities in educational outcomes related to socioeconomic status.”

Jesse Eisinger of ProPublica (the investigative journalism web site), however, has aptly pointed out that the “emperor”—or “the generational superman”—has no clothes. Eisinger explained that Zuckerberg’s decision to create a limited liability company for his Facebook shares was essentially “mov[ing] money from one pocket to the other.” Analyses of the Chan Zuckerberg “gift” by business commentators have confirmed this.

• It reduces taxes for the billionaire family. American tax law provides a deduction for stock sales based on “fair market value.” As Facebook stock is presumed to appreciate in value, at the time CZI donates stock to a charity, it will write off—not the cost of the stock when they received it from Zuckerberg—but its price at final sale. Therefore any gain in value is never taxed. Forbes reported that Zuckerberg “can potentially use that to shelter billions of other income.”

Judged by past practice, Zuckerberg’s interest in this aspect of the deal cannot be insubstantial. He already uses a donor-advised fund (the Silicon Valley Community Foundation), a relatively new and wildly popular device that generates an immediate tax deduction but has no requirement for charitable contribution. He also reportedly employs the “Double Irish” loophole to shift profits to the Cayman Islands. Gabriel Zucman, a tax haven specialist at UC Berkeley, dryly remarked, “I applaud their emphasis on ‘promoting equality’ but that starts with paying one’s taxes. A society where rich people decide for themselves how much taxes they pay and to what public goods they’re willing to contribute is not a civilized society.”

• The LLC has no legal responsibility to help anyone. There are no transparency requirements or rules regarding the disbursement of its assets. It is exempt from the “5 percent rule,” which stipulates a minimum of 5 percent of the holdings is to be donated each year. All decisions regarding the new business entity will be under the control of the Chan-Zuckerberg family.

World Socialist Web Site for more