TRAC IRS

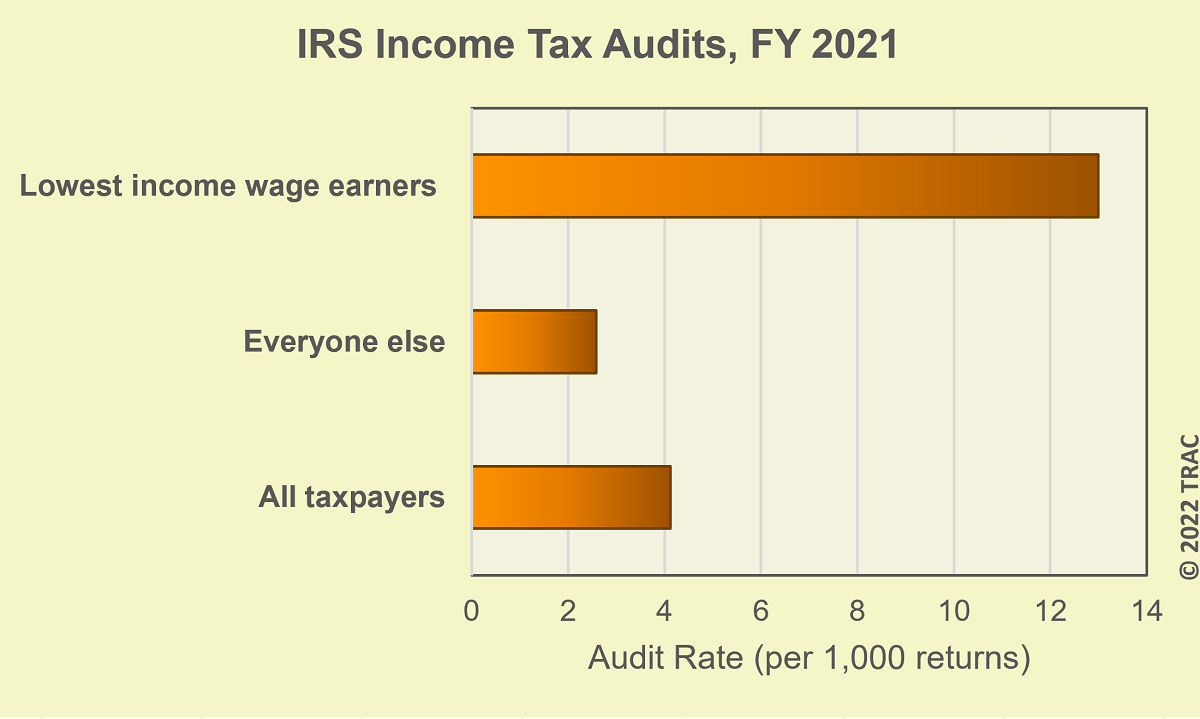

A large increase in federal income tax audits targeting the poorest wage earners allowed the Internal Revenue Service to keep overall audit numbers from further declines for Americans as a whole during FY 2021. That resulted in these low-income wage earners with less than $25,000 in total gross receipts being audited at a rate five times higher than for everyone else.

Table 1. Internal Revenue Service Audits of Individual Income Tax Returns, FY 2021

| Category of Taxpayer | Returns Filed | IRS Audits | Rate (per 1000) |

| Lowest income wage earners* | 23,620,209 | 306,944 | 13.0 |

| Everyone else | 136,457,242 | 352,059 | 2.6 |

| All taxpayers | 160,077,451 | 659,003 | 4.1 |

* with anti-poverty earned income credit

Last year out of over 160 million individual income tax returns that were filed, the IRS audited 659,003 – or just 4 out of every 1,000 returns filed (0.4%). This was only slightly lower than the overall odds of audit from FY 2019, and above FY 2020 levels where just 3 out of every 1,000 returns filed were examined[1]. Audit rates in general have been dropping for many years. See Figure 2.

These results are based on internal IRS reports released each month to the Transactional Records Access Clearinghouse (TRAC) at Syracuse University under a court order entered after successful litigation under the Freedom of Information Act.

IRS accomplished over 650 thousand audits last year by jacking up its already high reliance on so called “correspondence audits” – essentially a letter from the IRS asking for documentation on a specific line item on a return. All but 100,000 of the 659,000 audits were conducted with these letters through the mail. Correspondence audits during FY 2021 rose to 85% of all IRS tax audits — up from roughly 80 percent during the previous two years. See Table 2.

Trac IRS for more