by SHAIMAA KHALIL & TIFFANIE TURNBULL

“It’s devastating. The amount of time and effort you put in your home and then to see it go under water.”

Sam Bowstead is an architect who specialises in preparing houses to withstand natural disasters. But when floods engulfed his Brisbane home in February, he felt helpless.

“I’ve worked with people who’ve been in similar situations – now this happened to me,” he says.

“I was shocked at how fast [the water] rose… more than a metre in a couple of hours. I went from being worried about our property to being worried about our safety.”

In the end, a boat was the only way out.

Mr Bowstead’s experience has become increasingly common for Australians.

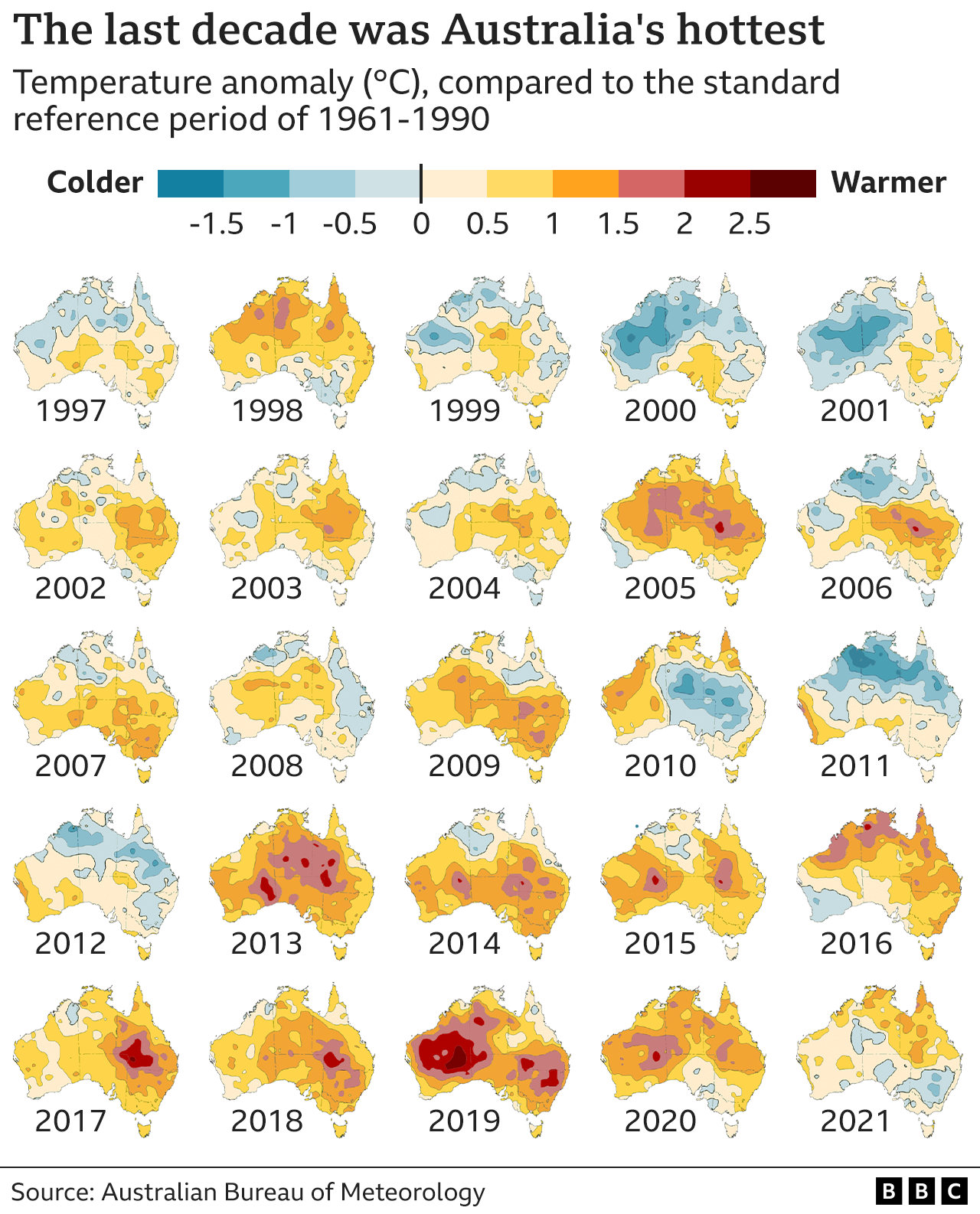

In the past three years, record-breaking bushfire and flood events have killed more than 500 people and billions of animals. Drought, cyclones and freak tides have gripped communities.

Climate change is a key concern for voters in Australia’s election on Saturday. So is the cost of living – and these issues are converging like never before.

Australia is facing an “insurability crisis” with one in 25 homes on track to be effectively uninsurable by 2030, according to a Climate Council report. Another one in 11 are at risk of being underinsured.

Insurance for the highest-risk homes will be prohibitively expensive or refused by providers, says the Climate Council, which created an interactive map for Australians to search.

“Climate change is playing out in real time here and many Australians now find it impossible to insure their homes and businesses,” says chief executive Amanda McKenzie.

The state most exposed

Nowhere is this a bigger issue than in Queensland. It is home to almost 40% of the 500,000 homes projected to be effectively uninsurable.

Queensland has been ravaged by floods in recent months. In February, the state capital Brisbane had more than 70% of its average yearly rainfall in just three days.

“I still feel quite traumatised when it rains heavily,” says Michelle Vine, whose East Brisbane home was destroyed along with decades of her artwork.

“We had to move out of the home – it became unliveable.”

Insurers say the floods – which also battered New South Wales – will become Australia’s most expensive flood event ever. But even before this year, insurance costs were skyrocketing.

Though rising property prices are one factor, Australia’s peak insurance industry body points the finger at climate change.

The Insurance Council of Australia says no parts of the country are currently uninsurable but there are “clearly affordability and availability concerns”.

Over the past decade, the amount paid out by insurers on damage claims from natural disasters has roughly doubled.

On average, consumers now pay almost four times for home insurance premiums than in 2004.

BBC for more