by CESAR J. AYALA

IMAGE/GNP and GDP data is from Puerto Rico Planning Board

IMAGE/GNP and GDP data is from Puerto Rico Planning Board

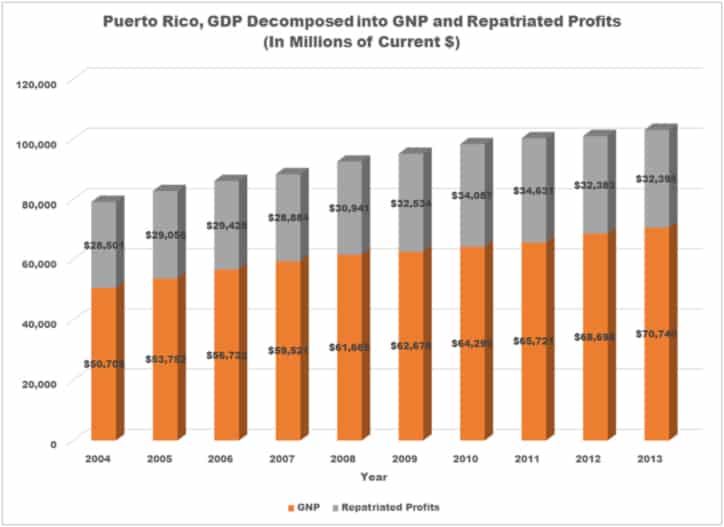

Beginning in the 1970s, Puerto Rico’s economy began to suffer a drain of profits, to the point where the measure of total income produced in the island, the Gross Domestic Product, began to separate dramatically from the measure of income that residents own, the Gross National Product or GNP.

This divergence owes itself to the extraordinary volume of profits that leave Puerto Rico into the hands of the foreign investors that control its economy. A third of the income that is generated in Puerto Rico leaves the country each year in the form of repatriated profits. In other words, the gross National Product of Puerto Rico, or the income that belongs to the residents of the island, is 67% of the total income generated there; the other third is taken away by U.S. corporations.

This is a phenomenal drain of resources in an economy controlled primarily by American multinational corporations. In the graph above, the columns represent the Gross Domestic Product of Puerto Rico, broken down into the part belonging to the island’s residents (GNP) and the part of the income that U.S. investors take home in the form of repatriated profits. Puerto Rico’s debt is currently valued at 70 billion dollars; U.S. corporations repatriated 313 billion dollars between 2004 and 2013. To put this drain in perspective, repatriated profits in the last decade alone are enough to pay the entire debt of Puerto Rico’s government and its public corporations four times over!

These payments to absentee capital constitute the elephant in the room that is never mentioned in discussions of Puerto Rico’s debt problems. If we take the last decade, the profits earned in two of the last ten years, or an equivalent of 20% in taxes on the total profits generated during that decade, would be enough to leave Puerto Rico free of debt.

Monthly Review Zine for more