by ANDY MERRIFIELD

If someone were to ask me what my favourite bit of Marx’s Capital is, I’d tell them Chapter 25, on “The General Law of Capitalist Accumulation.” Not that anybody has ever asked me; but I suspect I wouldn’t be alone in selecting this pinnacle performance, the beginning of the climatic unfurling of Volume One. For here those “laws of motion” that Marx had been trying to lay bare throughout Capital, really do motor before the reader’s very eyes, in all their disturbing fluidity. Hitherto, Marx had been attempting to piece together the intricate “inner mechanisms” of capitalist society. By Chapter 25, he’s ready to analyse these inner mechanisms as a giant well-oiled whirring machine.

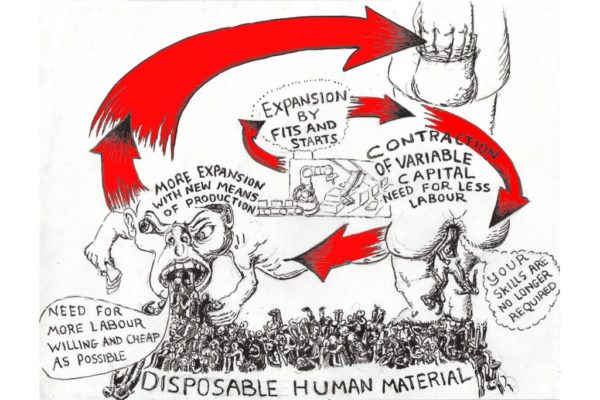

And he’s mesmerised by the prodigious power of this machine, by capital accumulating, bursting through every historical and geographical restriction, conquering the entire world of social wealth. Yet, at the same time, he’s appalled by the ruthless force it unleashes, by the horrors the machine inflicts upon its cogs. Meanwhile, its normal functioning soon takes on a spiralling dynamic all its own, operating beyond the control of any single capitalist master. After a while, the enviable freedom of the capitalist gets transformed into a die-hard necessity, into an infamous historical mission:

Accumulation for accumulation’s sake, production for production’s sake.

The drive to accumulate capital dramatically pits capitalist against capitalist, capitalist against worker, worker against worker. Accumulation fuels competition, and competition, Marx says, “subordinates every individual capitalist to the immanent laws of capitalist production, as external, coercive laws.” Thus, as capitalists strive to accumulate, as their actions become mere functions of capital, they inevitably clash with other capitalists seeking to do likewise. What erupts is a fratricidal war; different fractions of capital jostle one other, struggle to corner markets, to control and monopolise markets, to control and monopolise labour; a zero-sum accumulation mania transpires and conspires. Accumulation is the centrifugal impetus of “capital in general.” But competition hastens a splintering of capital, just as it hastens a splintering of labour, compounding each side into many “aliquot parts.” Thus, as capital accumulates, the formation and intensification of class structure manifests itself as a paradoxical obliteration of class structure.

Before long, the hullabaloo of accumulation is “supplemented” by concentration and centralisation, by big capitalist fishes gobbling up little fishes and sharks chomping on big fishes. Marx says this enhances the scale of operations, accelerates the overall effects of accumulation, but in uneven ways, for capitalists and workers alike. Trouble and strife brood. For, on the one hand, competition and the obligatory development of a credit system become powerful levers of centralisation—of the formation of joint stock companies, trusts and conglomerates, mergers and acquisitions—and of expanded accumulation; on the other hand, though, the “organic composition of capital”—the ratio of dead to living labour, of machines to workers, of constant to variable capital—gradually starts to creep upwards, diminishing the relative demand for labour.

Before long, too, the system breeds a new species: Marx labels them “a new financial aristocracy, a new variety of parasites in the shape of promoters, speculators and nominal directors, a whole system of swindling and cheating by means of corporation promotion, stock issuance, and stock speculation.” Could Marx be talking about us? By God yes. Nowadays, we know these people by name, by sleazy reputation; we know, too, that within the overall accumulation process this new financial aristocracy has a stake very different to that of productive capital’s.

The former plays a extremely limited, if any, enabling role for valorisation: stock exchanges are now billion dollar markets for speculating on already existing stocks and shares. Little activity here actually raises money for new productive investment. Businesses generate money by selling stock and shares, relinquishing part of the company to shareholders; but little of the accruing booty gets recycled into future investment. Invariably, it’s doled out as dividends, and/or creamed off through inflated CEO salaries.

Monthly Review Online for more