by NAVEED HUSSAIN

Western sanctions on Russia have set in motion a de-dollarisation drive which appears irreversible

“If the US dollar’s global supremacy erodes, America will face a reckoning like none before,” said political commentator Fareed Zakaria in a recent episode of his CNN show ‘Fareed Zakaria GPS’. This sums up the mood in Washington. The reckoning has begun. And we can feel the jitters all over, especially in the Western media, which is in overdrive to hypothesise doomsday scenarios over the imminent fall of the long-ensconced ‘hegemon’ of the financial world. This media noise is rapidly rising to a hysterical crescendo because ‘de-dollarisation’ would imperil the neo-colonialism of the West and its so-called ‘rules-based world order’, in which the dollar has long been ‘weaponised’ against the nations not aligned with the West in global geopolitics.

The West may loathe it, but a tectonic paradigm shift in global geo-economics is happening. The ‘king dollar’ is facing a revolt that could potentially dethrone it after nearly eight decades of undisputed reign over global trade. Countries are increasingly moving away from the greenback, eroding its dominance in international economy, which was ‘dollarised’ in the aftermath of World War II through the 1944 Bretton Woods regime. It might be too early to sound the death knell for the dollar, but the West’s use of the ‘financial nuclear bomb’ against Russia has accelerated efforts by the Global South to decouple from the greenback and hunt for alternatives. However, the end of dollar’s hegemony wouldn’t mean the rise of another hegemon. Instead, it would herald a new multicurrency economic order.

The dollar dominance has been shrinking since 1990 as its share of reserves currencies dropped from 70% to less than 60% in 20 years – and falling steadily, as per the IMF’s Currency Composition of Official Foreign Reserves data. A quarter of the decline is a shift into the Chinese currency yuan, also called renminbi, as well as nontraditional reserve currencies. The yuan has rightly been gaining traction because China is No 1 exporter and No 2 importer of the world. Cross-border yuan settlements grew 29% by value in 2021 compared to a year earlier, according to the People’s Bank of China’s (PBC) 2022 RMB Internationalisation Report. The Bank says it will continue to expand the coverage of cross-border yuan settlement services and aims to provide no less than 30 trillion yuan ($4.34 trillion) of settlement for domestic and foreign market entities throughout 2023.

The yuan appears to be emerging as a burgeoning alternative as countries are increasingly adopting it for bilateral trade with China – and even in multilateral business transactions. The yuan received a big boost when it was embraced by Russia, with which China’s trade is set to cross the $200 billion mark by the end of 2023. Two-thirds of their current trade is conducted in their local currencies. The yuan has also become a major player in Moscow’s foreign trade, with its share in the country’s import settlements jumping to 23% by the end of 2022 from only 4% in Jan 2022, as per the latest data from the Bank of Russia. Moreover, the yuan has replaced the dollar as the most traded currency in Russia in monthly trading volume in Feb 2023 for the first time, and the difference became more pronounced in March, according to a Bloomberg report.

President Vladimir Putin has said that his country is ready to increase settlements in yuan in its foreign trade. “We are for the use of Chinese yuan in settlements between Russia and the countries of Asia, Africa, and Latin America,” he said during a meeting with President Xi Jinping on his recent Moscow visit.

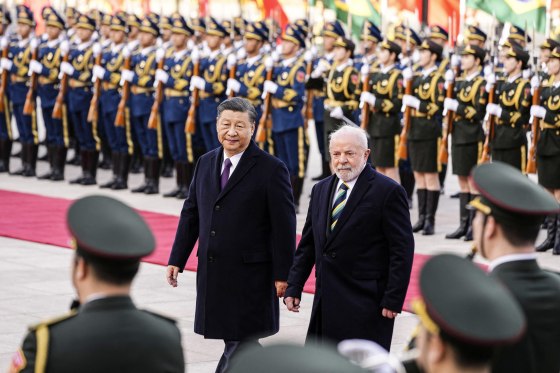

Meanwhile, the need to diversify away from the dollar is also being strongly felt in a region America once considered its backyard. Brazil, the biggest economy in South America, has recently signed an agreement with China on trade in mutual currencies. The deal will enable the two nations to conduct their massive $150 billion trade in their local currencies, abandoning the US dollar as an intermediary. According to the Secretary for International Affairs at the Ministry of Finance of Brazil, Tatiana Rosito, 25 countries are already making trade settlements with China in the yuan.

Surprisingly, interest in de-dollarising – or at least in greater use of local currencies – is also growing in the Persian Gulf region where the US has long wielded unrivaled strategic power. Oil-rich Saudi Arabia, which has pegged its riyal to the dollar for decades, is considering trading in other currencies as well. Beijing is the largest trading partner of Riyadh, with their bilateral trade touching $87.3 billion in 2021. The Saudis are considering conducting some of their oil sales to China in the yuan and including yuan-denominated futures contracts – known as the petroyuan – in the pricing model of the state-owned oil behemoth Aramco. If they follow through, this would considerably dent the dollar and boost the Chinese currency’s global standing.

Express Tribune for more